Best Life Insurance Plans 2025 – Complete Guide to Choosing the Right Policy for Your Family

Life insurance is one of the most powerful financial tools we have—yet the most misunderstood one. Most people think life insurance is just a way to save tax or a document for emergencies. But in reality, life insurance is the foundation of financial planning, a safety net that protects your family financially when you are not around.

The year 2025 brings new insurance trends, upgraded policy benefits, better digital claim settlement, and more cost-effective term insurance plans. With increasing inflation and rising living costs, selecting the right life insurance plan has never been more important.

What Is Life Insurance?

Life insurance is a contract where the insurance company promises to pay a lump sum amount (called sum assured) to your family if something happens to you. In exchange, you pay a regular premium.

Life insurance = Risk protection + Financial security + Peace of mind

There are two main purposes of life insurance:

-

Income replacement – So your family continues to live comfortably.

-

Long-term savings & investment – Based on the type of plan you choose.

Importance of Life Insurance in 2025

2025 changed the insurance landscape:

✔ High medical inflation

✔ Rise in lifestyle diseases

✔ Increasing loan/EMI dependency

✔ Expensive children’s education

✔ Uncertain job market

Life insurance provides a financial shield that protects your family from these uncertainties.

Types of Life Insurance Plans in 2025

Before choosing the best plan, understand the major types:

🔵 1. Term Life Insurance (Pure Protection Plan)

-

Most affordable

-

Highest coverage (1–5 crore)

-

No maturity amount

-

Best for financial protection

🟢 2. Whole Life Insurance

-

Lifetime coverage till age 99

-

Suitable for legacy planning

🟣 3. Endowment Plan (Savings + Insurance)

-

Fixed returns

-

Low risk

-

Best for low-risk investors

🟠 4. ULIP (Investment + Insurance)

-

Market-linked returns

-

Lock-in 5 years

-

Best for long-term wealth creation

🟡 5. Money-Back Plan

-

Periodic payouts

-

Good for people who want liquidity

How to Choose the Best Life Insurance Plan in 2025

Here are the final selection criteria:

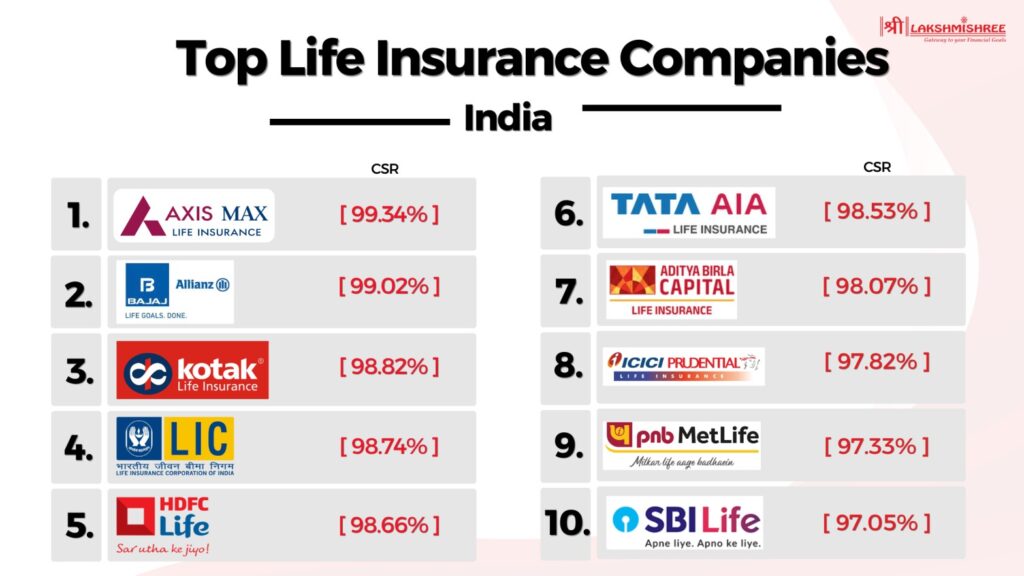

✔ 1. Claim Settlement Ratio (CSR)

At least 97% or above.

✔ 2. Solvency Ratio

Shows the company’s financial stability.

Should be 1.5+.

✔ 3. Premium affordability

Choose premium that fits your long-term budget.

✔ 4. Sum assured recommended formula

Sum Assured = 20× Annual Income

(Or at least ₹1 crore minimum)

✔ 5. Riders & Add-ons

-

Accidental death rider

-

Critical illness cover

-

Waiver of premium rider

Makes policy powerful.

Best Life Insurance Plans 2025 (Full Ranking)

Below is the expert-level ranking, based on claim ratio, premium, features, riders, and customer satisfaction.

1. LIC Tech Term (Best Overall Term Plan)

Why it’s #1:

-

LIC’s trust

-

Excellent claim settlement

-

Affordable premiums

-

Customizable benefits

Key Features:

-

Online exclusive plan

-

Level & Increasing cover options

-

Accident benefit rider

-

Coverage up to 80 years

-

Worldwide coverage

Best For:

Anyone looking for the safest and most trustworthy plan.

2. HDFC Click 2 Protect Life

Why it’s excellent:

-

High sum assured

-

Many customization options

Key Features:

-

Return of premium option

-

Terminal illness benefit

-

Premium waiver rider

-

Long-term policy

Best For:

Professionals wanting high flexible protection.

3. ICICI iProtect Smart

Why it stands out:

-

Covers 34 critical illnesses

-

Claims settled quickly

Key Features:

-

Accidental death rider

-

Critical illness payout

-

Income + Lump sum payout options

Best For:

People looking for premium protection + critical care.

4. Max Life Smart Secure Plus

-

High claim settlement ratio (~99%)

-

Low premium for young adults

-

Multiple riders

Best For:

Young earners with tight budgets.

5. Tata AIA Sampoorna Raksha Supreme

-

Market’s fastest claim settlement

-

Free medical check-up

-

Strong financial backing

Best For:

Families needing ultra-safe protection.

6. SBI Life eShield Next

-

Affordable

-

Covers life stages

-

Trusted bank-backed insurer

Best For:

People who prefer stability + SBI brand trust.

7. Bajaj Allianz Smart Protect Goal

-

Covers 55 critical illnesses

-

Child education benefit

Best For:

Parents wanting structured family protection.

8. Aditya Birla SunLife DigiShield

-

10 plan options

-

Early payout on critical diseases

Best For:

People wanting flexibility with many variants.

Premium Comparison: Best Life Insurance Plans 2025

| Company | Sum Assured | Age 30 | Age 35 | Age 40 |

|---|---|---|---|---|

| LIC Tech Term | ₹1 Cr | ₹12,500 | ₹15,800 | ₹22,000 |

| HDFC Click 2 Protect | ₹1 Cr | ₹11,400 | ₹14,500 | ₹20,300 |

| ICICI iProtect | ₹1 Cr | ₹10,900 | ₹14,800 | ₹22,600 |

| Max Life Smart Secure | ₹1 Cr | ₹9,900 | ₹13,900 | ₹19,500 |

| Tata AIA Raksha | ₹1 Cr | ₹10,700 | ₹13,500 | ₹18,900 |

(Premiums are approximate & may vary.)

Which Life Insurance Plan Is Best for You? (Based on Needs)

✔ Best for salaried middle-class

Max Life Smart Secure / HDFC Click 2 Protect

✔ Best for self-employed

ICICI iProtect Smart

✔ Best for family people

Bajaj Smart Protect Goal

✔ Best for students or freshers

Max Life Smart Secure (cheapest premium)

✔ Best for NRIs

Tata AIA / ICICI

✔ Best for age 45+

LIC Tech Term (strong senior-friendly claim reliability)

Key Riders You MUST Add in 2025

⭐ 1. Critical Illness Rider

Covers diseases like cancer, heart attack, kidney failure.

⭐ 2. Accidental Death Rider

Extra payout if death happens due to accident.

⭐ 3. Premium Waiver Rider

If you get permanently disabled or critically ill, future premiums are waived.

⭐ 4. Hospital Cash Rider

Pays cash for hospitalization per day.

These riders make your policy complete.

Common Mistakes to Avoid When Buying Life Insurance (2025)

❌ Choosing low coverage (less than 1 crore)

❌ Buying endowment instead of term

❌ Not adding riders

❌ Choosing 10-year policy instead of 40-year

❌ Not disclosing medical history

❌ Not comparing premiums

Avoid these mistakes to protect your family correctly.

Frequently Asked Questions

1. Which life insurance is best in 2025?

LIC Tech Term, HDFC Life, and Max Life plans rank highest.

2. What is the ideal life insurance coverage?

20× annual income (minimum ₹1 crore).

3. What age is best to buy life insurance?

21 to 35 for lowest premium.

4. Is term insurance better than whole life?

Yes, term insurance is pure protection and cheaper.

5. Can I buy multiple life insurance policies?

Yes, unlimited.

6. Can NRI buy Indian life insurance?

Yes, from companies like Tata AIA, HDFC, ICICI.

7. What happens if I miss a premium?

Grace period of 15–30 days.

8. Does life insurance cover COVID-19?

Yes.

9. Does life insurance cover suicide?

Covered after 1 year (as per IRDAI rule).

10. Which is the cheapest term insurance?

Max Life Smart Secure (for young adults).

11. Can I increase coverage later?

Yes, with life stage benefit.

12. How are claims settled?

Nominee submits documents → insurer pays sum assured.

13. What if insurer rejects my claim?

You can approach IRDAI or Insurance Ombudsman.

14. Does smoking affect premium?

Yes, smokers pay higher premium.

15. Which plan offers the highest claim settlement ratio?

Max Life (~99.6%).

Conclusion

Choosing the right life insurance plan in 2025 is one of the most important financial decisions you will make for your family. With rising inflation, unpredictable medical emergencies, and increasing financial responsibilities, life insurance acts as a powerful protective shield. Among all available options, term insurance remains the gold standard because it offers high coverage at an affordable premium. Plans like LIC Tech Term, HDFC Click 2 Protect, ICICI iProtect Smart, and Max Life Smart Secure are among the best for 2025 due to strong claim settlement records, flexible features, and customer-friendly pricing. Always compare premiums, add essential riders like critical illness and accidental death, and choose coverage at least 20× your annual income. A well-chosen life insurance policy guarantees financial safety, peace of mind, and long-term security for your loved ones.

Disclaimer

This article is for educational purposes only and does not constitute financial or insurance advice. Life insurance products are subject to terms and conditions of individual insurers. Premiums, benefits, and features may vary based on age, health, income, and underwriting rules. Readers are advised to consult a certified financial advisor or insurance expert before purchasing any policy. We do not guarantee accuracy of data, policy performance, or claim outcomes. The author and website will not be responsible for any financial decisions based on this content.