What Is STP? (Systematic Transfer Plan) – Full Explanation

A Systematic Transfer Plan (STP) is a smart mutual fund investment strategy where you regularly transfer money from one mutual fund scheme to another, at fixed intervals (daily, weekly, monthly).

Example:

You invest ₹1,00,000 in a debt fund, and then automatically transfer ₹10,000 every month to an equity fund.

STP = Automatic, scheduled, disciplined transfer of funds.

It helps investors reduce risk, benefit from rupee cost averaging, and maintain long-term asset allocation.

Why Investors Use STP in 2025?

Because markets are unpredictable. STP helps you:

✔ Avoid timing the market

✔ Reduce risk when investing lump sum in equity

✔ Maintain portfolio balance

✔ Switch from volatile funds to safer funds

✔ Generate better returns through disciplined investing

In short, STP = Risk-management + Growth strategy.

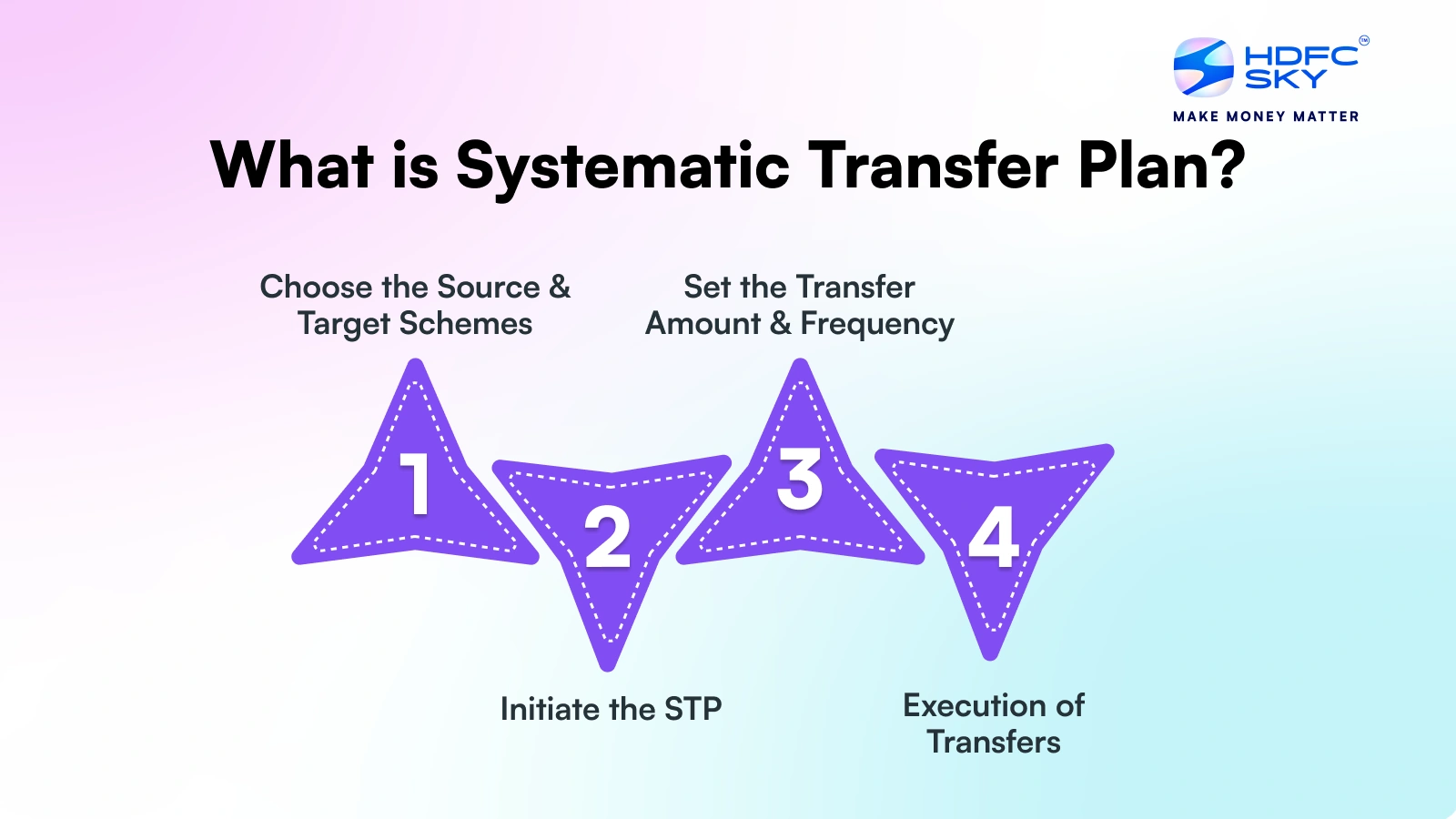

How STP Works (Simple Explanation)

STP involves three components:

-

Source Fund → Where the money stays initially

(Typically, a debt fund, liquid fund, or ultra-short duration fund) -

Target Fund → Where the money gets transferred

(Usually, equity mutual fund, index fund, or hybrid fund) -

Frequency + Amount

-

Monthly STP

-

Weekly STP

-

Daily STP

-

Quarterly STP

-

Money moves automatically at the selected frequency.

Example of STP (Clear Example)

You invest ₹3,00,000 in a Liquid Fund.

You set up:

-

STP to Nifty 50 Index Fund

-

₹25,000 per month

-

For 12 months

Your money stays safe in debt fund → earns stable returns → moves into equity gradually.

This helps avoid investment at peak market levels.

Types of STP (2025 Updated)

There are three main types of STP in India:

1. Fixed STP

A fixed amount is transferred regularly.

Example: ₹10,000 monthly from debt to equity fund.

2. Flexible STP (Smart STP)

Amount changes based on market conditions.

-

Invest more when market is low

-

Invest less when market is high

This type is used by advanced investors.

3. Capital Appreciation STP

Only the profits generated in the source fund are transferred.

Example:

Debt fund investment grows from ₹3,00,000 → ₹3,05,000

Profit = ₹5,000 → This ₹5,000 moves to equity fund.

Benefits of STP (Why It’s Better Than Lump Sum Investment)

STP is popular because of:

1. Rupee Cost Averaging

You buy equity mutual fund units at different market levels.

This reduces the risk of bad entry.

2. Better Than Lump Sum in Volatile Markets

Instead of putting ₹3 lakh at once into equity, STP spreads the investment across time.

3. Earn Extra Returns in Source Fund

Your money parked in a debt fund generates 6–7% stable returns until transferred.

4. Maintains Asset Allocation

STP helps rebalance your portfolio automatically.

5. Avoids Emotional Decisions

Invests regularly without fear, greed, or hesitation.

Who Should Invest Through STP?

Ideal for:

-

Investors with lump sum money

-

People entering equity but afraid of market timing

-

Investors who want low-risk entry into equity

-

People doing portfolios rebalancing

-

Retirees moving equity gains to debt

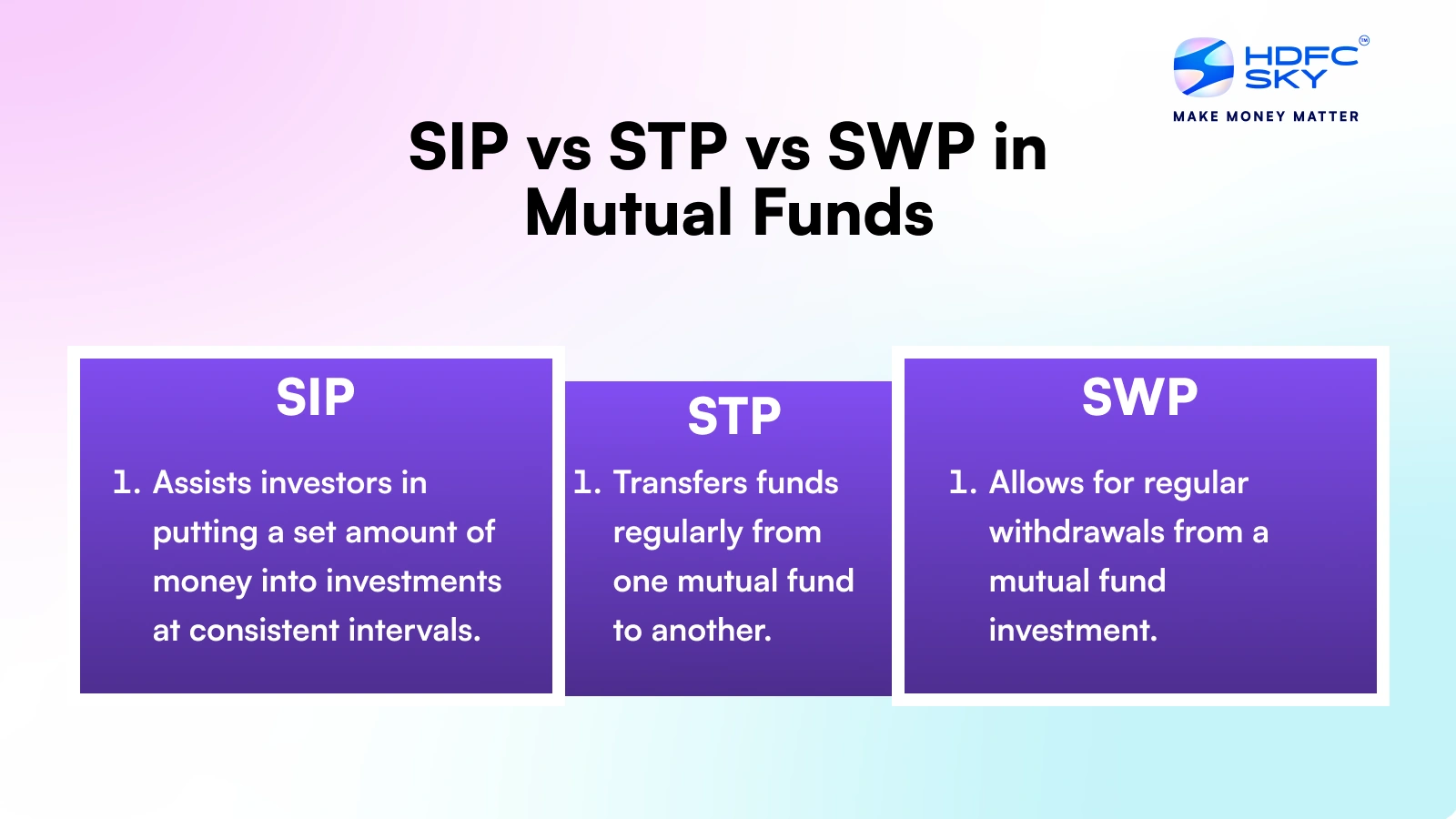

STP vs SIP vs SWP (Difference Table)

| Feature | STP | SIP | SWP |

|---|---|---|---|

| Full Form | Systematic Transfer Plan | Systematic Investment Plan | Systematic Withdrawal Plan |

| Purpose | Transfer money | Invest money | Withdraw money |

| Movement | Between funds | Bank → Fund | Fund → Bank |

| Risk Level | Medium | Medium | Low |

| Best For | Lump sum investors | Monthly savers | Retirees |

STP Taxation Rules (Very Important for 2025)

✔ Every STP transfer is treated as a redemption from the source fund.

So capital gains tax applies.

Tax depends on source fund type:

1. STP from Debt Fund → Equity Fund

Short-Term Capital Gain (STCG):

If units redeemed within 3 years → taxed as per income slab.

Long-Term Capital Gain (LTCG):

After 3 years → taxed at 20% with indexation.

2. STP from Equity Fund → Hybrid/Equity Fund

STCG (within 1 year) = 15%

LTCG (after 1 year) = 10% above ₹1 lakh gain

3. STP from Liquid/Ultra-Short Funds

These are debt funds → taxed based on 3-year holding rule.

Does STP Guarantee Profit?

No.

But STP reduces risk and smoothens returns, making investing safer.

It is not a tool for high returns — it’s a risk management strategy.

Best STP Strategies for 2025

Here are the most effective strategies:

1. 12-Month STP for Lump Sum Investors

Put entire money into a debt fund → Transfer to equity over 12 months.

2. Smart STP (Market Level Based)

Invest more when markets fall below a specific PE ratio.

3. Capital Appreciation STP

Best for retirees or conservative investors.

4. Reverse STP

Transfer profits from equity → debt fund to protect gains.

Which Funds Are Best for STP?

Source Funds (where money is parked first)

-

Liquid Funds

-

Ultra-Short Duration Funds

-

Low-Duration Debt Funds

Target Funds (where money is invested)

-

Index Funds

-

Large Cap Funds

-

Flexi Cap Funds

-

Hybrid Aggressive Funds

Avoid STP into sector or thematic funds.

How Much Should You Transfer in STP?

A good strategy is the 1% rule:

Transfer 1% to 2% of the total amount per week

or

5% to 10% per month.

Example:

Amount = ₹10,00,000

STP = ₹50,000 to ₹1,00,000 per month.

Common Mistakes to Avoid in STP

-

Using equity fund as source fund

-

Too short STP duration

-

Too long STP (miss growth)

-

Choosing high-risk funds

-

Ignoring taxation

-

Stopping STP out of fear

Frequently Asked Questions

1. What is STP in mutual funds?

STP is a method to transfer money automatically from one mutual fund to another.

2. Who should use STP?

Investors with lump sum money who want gradual equity exposure.

3. How long should an STP be?

6–12 months is ideal for most investors.

4. Is STP better than SIP?

For lump sum investment → Yes, STP is better.

5. Does STP reduce risk?

Yes, because it spreads investment across market levels.

6. Can I cancel STP anytime?

Yes, through your mutual fund portal.

7. Is STP tax-free?

No, each transfer is taxed as redemption.

8. Which fund is best for STP source?

Liquid or ultra-short debt funds.

9. Which fund is best for STP target?

Large cap, flexi cap, or index funds.

10. What is flexible STP?

Amount varies based on market conditions.

11. What is capital appreciation STP?

Only the profit is transferred.

12. What is reverse STP?

Movement from equity → debt to protect gains.

13. Can I start STP with ₹1 lakh?

Yes, minimum amounts depend on fund house.

14. Does STP help during market crash?

Yes, because you invest gradually at lower prices.

15. Can I set daily STP?

Yes, many AMCs allow daily STP.

Conclusion

STP (Systematic Transfer Plan) is one of the smartest investing tools for anyone who wants to invest lump sum money safely into equity or rebalance their portfolio efficiently. By transferring money from a low-risk debt fund into an equity fund at regular intervals, STP reduces volatility, smoothens returns, and minimizes market timing risks. It offers rupee cost averaging, protects capital, and ensures disciplined long-term investing. Although STP does not guarantee profits,

it remains one of the best strategies for entering the market in a structured and risk-managed way. Whether you are a beginner or an experienced investor, using STP wisely in 2025 can significantly improve your investment experience and help you achieve long-term financial goals with confidence and stability.

Disclaimer

This article is for educational purposes only and should not be considered financial, tax, or investment advice. Mutual fund investments are subject to market risks. STP strategies depend on individual financial goals, risk profile, and market conditions. Please consult a certified financial advisor before making any investment decisions. The author and website are not responsible for any financial losses arising from investment actions based on this content.