⭐ What Is SWP?

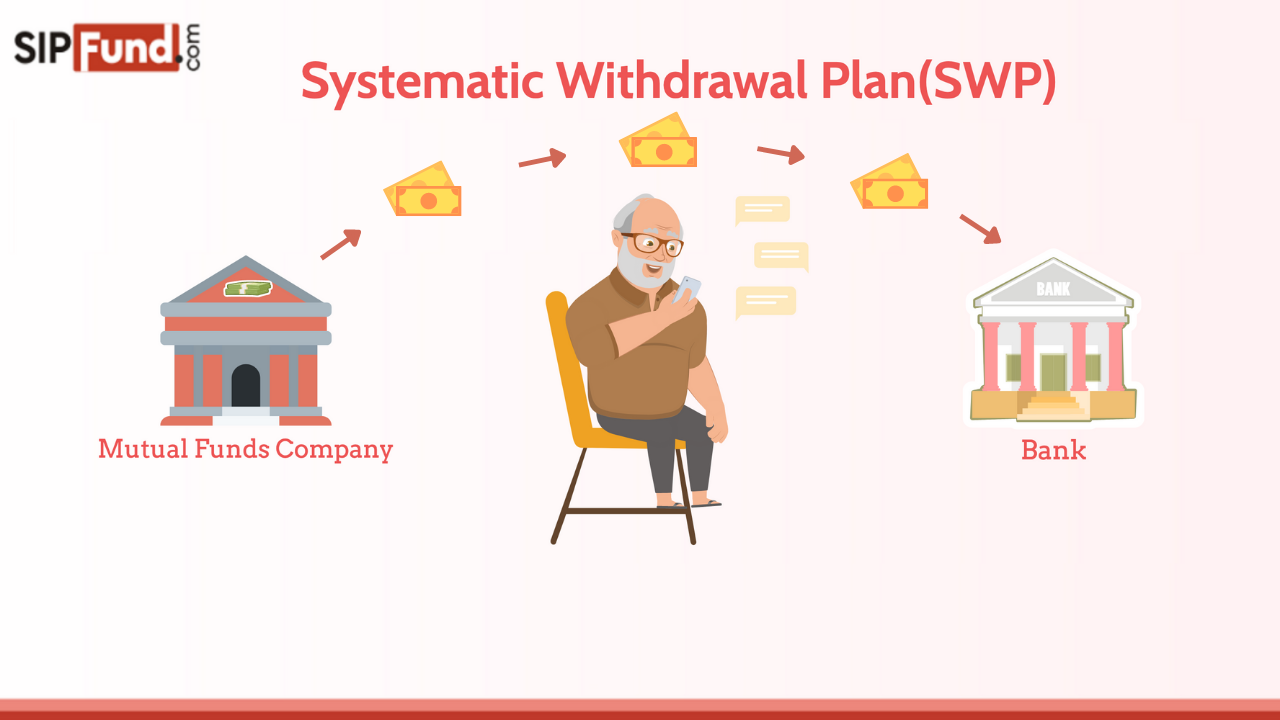

SWP stands for Systematic Withdrawal Plan.

It is a method in mutual funds that allows you to withdraw a fixed amount regularly, such as monthly, quarterly, or yearly, while the remaining money continues to stay invested and grow.

👉 SIP = Systematic Investment Plan (Money IN)

👉 SWP = Systematic Withdrawal Plan (Money OUT)

With SWP, you decide:

-

How much money you want to withdraw

-

How often you want to withdraw

-

How long the withdrawals should continue

This makes SWP an excellent tool for passive income, retirement income, or monthly expenses.

⭐ How Does SWP Work? (Step-by-Step)

SWP is very simple to understand:

✔ 1. You invest a lump sum amount

Example: ₹10,00,000 in a mutual fund.

✔ 2. You set a fixed withdrawal amount

Example: ₹10,000 per month.

✔ 3. Every month, the mutual fund redeems units equal to ₹10,000

Units redeemed = Withdrawal amount ÷ NAV.

✔ 4. Remaining units stay invested and continue growing

If fund return > withdrawal rate → capital grows

If fund return < withdrawal rate → capital reduces slowly

✔ 5. You keep receiving regular income

Like a salary or pension.

⭐ Why SWP Is Popular (Main Benefits)

✔ 1. Regular & Predictable Income

SWP gives you a stable monthly income just like a salary or pension.

Perfect for:

-

Retirees

-

Freelancers

-

Home-makers

-

Business owners

✔ 2. Better Than Bank FD Interest

FD interest is fixed but taxable at a higher rate.

SWP provides potentially higher returns and lower tax.

✔ 3. Your Money Keeps Growing

Only a part of your investment is withdrawn.

The remaining continues to grow through compounding.

✔ 4. Highly Flexible

You can:

-

Change withdrawal amount

-

Pause SWP

-

Stop SWP

-

Increase or decrease SWP anytime

✔ 5. Tax-efficient income

You pay tax only on capital gains, not on the entire withdrawal.

✔ 6. Perfect for Retirement Planning

Instead of withdrawing the whole corpus, SWP gives you controlled, stable income.

⭐ SWP Example (Real-Life Calculation)

Let’s take a clear example:

-

Investment: ₹10,00,000

-

SWP withdrawal: ₹10,000 per month

-

Expected return: 10% per year

-

Annual return: ₹1,00,000

-

Annual withdrawal: ₹1,20,000

Net impact:

Corpus reduces slightly, but still lasts many years.

However, if return = 10% and withdrawal = 7%

Corpus may grow instead of reducing.

⭐ SWP Calculation Example (With Units)

Suppose:

-

Investment: ₹5,00,000

-

Withdrawal: ₹7,000 per month

-

NAV = ₹50

Units redeemed monthly =

₹7,000 ÷ ₹50 = 140 units

If NAV increases next month to ₹52,

Units redeemed = 7000 ÷ 52 = 134.61 units

👉 Higher NAV = fewer units redeemed

👉 Remaining units grow faster

⭐ SWP Withdrawal Strategies (Expert Recommended)

🔹 1. 4% Rule (Safest Withdrawal Strategy)

Withdraw only 4% of your total corpus per year.

Example:

Corpus = ₹30 lakh

4% = ₹1.2 lakh/year ≈ ₹10,000/month

Very safe for long-term retirement.

🔹 2. 6% Balanced Strategy

Withdraw 6% yearly.

Works well with balanced advantage funds.

🔹 3. Income + Growth Strategy

Combine SWP withdrawals with reinvested returns.

🔹 4. Inflation-Adjusted SWP

Increase SWP amount every year by 5–7% to beat inflation.

⭐ Types of SWP

✔ 1. Fixed Amount SWP

Withdraw a fixed amount monthly.

✔ 2. Appreciation SWP

Withdraw only the profit earned, not the capital.

Example:

Investment: ₹10 lakh

Monthly return: ₹8,000

SWP: ₹8,000

Capital remains intact.

✔ 3. Customized SWP

Withdraw any amount at any frequency you choose.

⭐ Best Funds for SWP

🟩 Hybrid Funds (most stable)

-

Balanced Advantage Funds

-

Conservative Hybrid Funds

-

Equity Savings Funds

🟦 Equity Funds (for long-term SWP)

Use only for 5+ years.

🟧 Debt Funds (safe for retirees)

-

Corporate Bond Funds

-

Short Duration Funds

-

Banking & PSU Funds

⭐ SWP vs SIP vs FD vs Dividend Plan (Comparison Table)

| Feature | SIP | SWP | FD | Dividend Plan |

|---|---|---|---|---|

| Purpose | Investing | Withdrawing | Saving | Income |

| Risk | Market | Market | Low | Market |

| Return | High | High | Low | Variable |

| Tax | On gains | On gains | High | High |

| Flexibility | High | Very High | Low | Low |

| Best For | Wealth creation | Monthly income | Safety | Occasional income |

🏆 Best for retirement income: SWP

🏆 Best for wealth creation: SIP

⭐ Who Should Use SWP?

SWP is ideal for:

-

Retired individuals

-

People needing monthly income

-

Investors who want controlled withdrawal

-

Business owners

-

Homemakers

-

Freelancers

-

Investors wanting tax-efficient cashflow

If you want a monthly income without breaking your FD, SWP is perfect.

⭐ How Long Will Your SWP Last? (Simple Chart)

| Monthly SWP | Corpus Needed (Returns 10%) |

|---|---|

| ₹10,000 | ₹18–20 lakh |

| ₹20,000 | ₹35–40 lakh |

| ₹30,000 | ₹55–60 lakh |

| ₹50,000 | ₹90–100 lakh |

Lower withdrawal amount = longer survival.

⭐ Taxation of SWP (Very Important)

SWP is very tax-efficient.

✔ 1. Tax applies only on capital gains

NOT on the entire withdrawal.

✔ 2. Equity Fund Tax

-

< 1 year: 15%

-

1 year: 10% (after ₹1 lakh exemption)

✔ 3. Debt Fund Tax

-

Taxed as per your tax slab

-

No indexation after 2023 rules

👉 Still more tax-efficient than FD interest, which is fully taxable.

⭐ Common Myths About SWP (Busted)

❌ Myth 1: SWP guarantees income

Wrong. SWP depends on fund performance.

❌ Myth 2: SWP reduces your capital quickly

Only if withdrawal > returns.

❌ Myth 3: SWP is risky for seniors

Debt-based SWP is extremely stable.

❌ Myth 4: SWP is same as dividend option

Dividend depends on fund; SWP is fixed and controlled.

⭐ Mistakes to Avoid in SWP

⚠ 1. Withdrawing too much

Ideal withdrawal = 4–6% annually.

⚠ 2. Choosing risky small-cap funds for SWP

SWP needs stability. Hybrid/debt funds are better.

⚠ 3. Starting SWP immediately after investment

Always give at least 1–2 years for capital growth.

⚠ 4. Not adjusting SWP for inflation

⭐ Step-by-Step: How to Start an SWP

✔ Step 1: Choose a lump sum amount

Example: ₹10 lakh.

✔ Step 2: Pick the right fund

Balanced Advantage or Debt fund recommended.

✔ Step 3: Choose withdrawal amount

Example: ₹10,000/month.

✔ Step 4: Select frequency

-

Monthly (most common)

-

Quarterly

-

Annually

✔ Step 5: Start SWP

Money will auto-credit into your bank.

⭐ Advantages of SWP Over FD

| Feature | SWP | FD |

|---|---|---|

| Return | Higher | Lower |

| Tax | Lower | Higher |

| Flexibility | High | Low |

| Liquidity | High | Low |

| Inflation protection | Yes | No |

🥇 Winner: SWP in long term.

⭐ 15 FAQs About SWP (Easy Answers)

1. What is SWP?

A plan to withdraw money regularly from mutual funds.

2. Can I withdraw anytime?

Yes, SWP is flexible.

3. Is SWP safe?

Yes, especially in hybrid or debt funds.

4. Minimum SWP amount?

₹500–₹1000 per month.

5. Can SWP run forever?

Yes, if withdrawal < returns.

6. Can I increase SWP later?

Yes, anytime.

7. Is SWP better than dividends?

Yes—stable, predictable, flexible.

8. Can SWP be used for retirement income?

Absolutely.

9. Does SWP have lock-in?

Only if investment is in ELSS fund.

10. Is SWP tax-free?

No, but very tax-efficient.

11. Can NRIs use SWP?

Yes.

12. Which fund is best for SWP?

Balanced Advantage Funds.

13. What happens if NAV falls?

More units are redeemed.

14. What happens if NAV rises?

Fewer units are redeemed.

15. Is SWP risky in equity funds?

Short-term yes, long-term manageable.

⭐ Conclusion

SWP is one of the most reliable and flexible tools for generating regular income from mutual fund investments. Unlike traditional income sources such as fixed deposits, SWP offers better tax efficiency, higher growth potential, and complete control over how much you want to withdraw and when. It is especially suitable for retirees, freelancers, and anyone who needs consistent monthly income without disturbing their long-term investment value.

With proper fund selection, a safe withdrawal rate (4–6%), and long-term planning, SWP can help preserve capital while providing a steady cash flow. Whether your goal is financial independence, retirement income, or passive earnings, SWP gives you a disciplined, predictable, and intelligent way to access your wealth. If you want a modern alternative to FD interest or pensions, SWP is the smartest strategy you can adopt today.

📘 Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as financial, investment, or legal advice. Mutual fund investments, including SIP (Systematic Investment Plan) and SWP (Systematic Withdrawal Plan), are subject to market risks. Past performance does not guarantee future returns. Investors are advised to conduct their own research and consult with a certified financial advisor before making any investment decisions. The examples, calculations, charts, and projections shown are only for illustration and may vary based on market conditions. We do not guarantee any returns, profits, or accuracy of information. By using this content, you agree that the author and website will not be held responsible for any financial losses or decisions taken based on this information.