1. Introduction

Have you ever bought a cryptocurrency and wondered how much profit or loss you’ve made today? If yes, you’re not alone. Thousands of crypto traders, investors, and enthusiasts face the same question every single day. That’s exactly where a Crypto Profit & Loss Calculator comes to your rescue.

This calculator helps you instantly know whether you’re in profit or loss on your crypto investments — using live market data. It’s not just another static tool; it’s powered by real-time prices fetched directly from Binance, one of the world’s largest crypto exchanges. With this, you can track more than 500 cryptocurrencies, calculate your gains in seconds, and even share your results with your friends and trading groups online.

The tool is designed with simplicity in mind. Whether you’re new to crypto or an experienced trader, you can use it effortlessly. Just enter your buy price, quantity, and coin name, then sit back for 15 seconds as the progress bar loads. Once done, you’ll get a full breakdown of your total investment, current value, and the exact amount of profit or loss you’ve made — both in dollars and percentage.

In the fast-moving world of crypto, every second matters. Market prices fluctuate every minute, and missing out on these changes could mean losing valuable profits. This calculator gives you accurate insights in real-time, helping you make smarter and faster trading decisions.

It’s free, fast, and built for everyone — from Bitcoin holders to altcoin traders. So, whether you’re managing your long-term portfolio or making short-term trades, this calculator keeps you informed and confident in every move.

Before diving deeper into how the calculator works, it’s essential to understand what “profit” and “loss” mean in the world of cryptocurrency trading.

A profit happens when the current market price of your crypto is higher than the price you bought it at. A loss, on the other hand, occurs when the current market price drops below your purchase price. For example, if you bought 1 Bitcoin at $30,000 and the live market price today is $35,000, you’ve earned a profit of $5,000. But if Bitcoin’s price falls to $28,000, you’re looking at a loss of $2,000.

However, calculating these numbers manually can be tricky. You have to multiply the quantity by both buy and current prices, subtract the values, and then calculate the percentage. In fast-changing crypto markets, these calculations can be outdated within minutes. That’s why having a live calculator that updates in real-time is a huge advantage.

Crypto profits and losses also depend on timing. The market is extremely volatile — prices can rise or fall by 10% in a single day. Additionally, external factors like global news, government policies, and exchange activity can drastically impact your holdings. This makes tracking profits manually both time-consuming and prone to human error.

With this calculator, you get instant clarity. No formulas, no spreadsheets — just accurate, live profit/loss numbers that update automatically. This helps traders stay alert, make better exit decisions, and manage risk effectively.

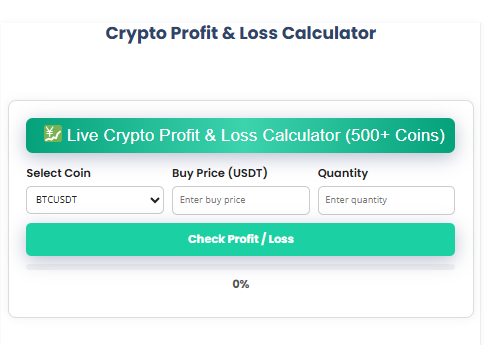

3. How the Live Crypto Profit & Loss Calculator Works

The live Crypto Profit & Loss Calculator is powered by modern web technology and real-time API data from Binance. Here’s how it works in simple terms:

You select your coin (like BTCUSDT, ETHUSDT, DOGEUSDT, etc.).

You enter your buy price and the quantity you hold.

Once you click “Check Profit/Loss”, the tool starts a 15-second progress bar, simulating a live calculation process.

In the background, the calculator fetches live market data for your chosen coin using the Binance API.

It then compares your purchase price to the current live price and displays your total investment, current value, and the difference between them (profit or loss).

The tool is built with JavaScript, which means it performs all calculations directly in your browser — no server-side processing or personal data sharing. This ensures 100% privacy while delivering accurate real-time insights.

If your investment has appreciated, the calculator highlights your profit in green, along with the profit percentage. If your investment has declined, it shows your loss in red for quick identification.

The live market price is also displayed separately below the result, so you always know the latest value of your crypto coin in USD.

4. Key Features of the Calculator

This isn’t your average online calculator — it’s a feature-rich, interactive tool designed to make crypto tracking enjoyable and effortless. Here’s what sets it apart:

Live Coin List (500+ Coins) – It loads hundreds of live cryptocurrencies directly from Binance, ensuring you always have up-to-date data.

15-Second Progress Bar Animation – Adds a touch of excitement and professionalism while data is fetched and processed.

Real-Time Price Updates – No need to refresh or recheck; the calculator uses live data from Binance API.

Detailed Breakdown – You see your total investment, current value, and profit/loss amount clearly separated.

Color-Coded Results – Green for profit, red for loss, making it visually easy to interpret.

Social Share Buttons – Share your profit/loss instantly on WhatsApp, Facebook, X (Twitter), and Telegram.

No Login or Sign-Up – The calculator is fully free and requires no registration.

Privacy-Friendly – All calculations happen in your browser, so your data never leaves your device.

Mobile-Responsive Design – Works perfectly on phones, tablets, and desktops.

With this tool, you get an elegant, user-friendly experience that gives you both accuracy and speed — two things every trader needs.

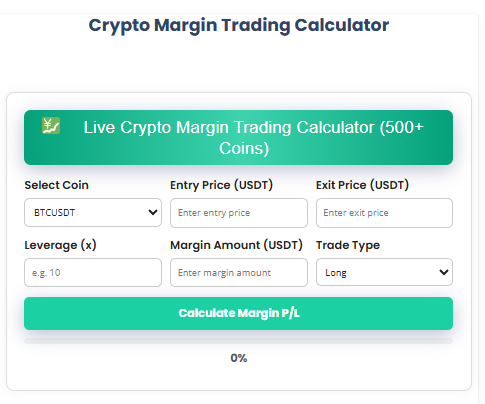

5. Step-by-Step Guide to Using the Calculator

Using this Crypto Profit & Loss Calculator is as easy as 1-2-3. Let’s walk through the steps:

Step 1:

Select your cryptocurrency from the dropdown list — for example, BTCUSDT (Bitcoin), ETHUSDT (Ethereum), or DOGEUSDT (Dogecoin). The list is updated live from Binance and includes over 500 coins.

Step 2:

Enter your Buy Price (the price at which you purchased the coin) and the Quantity you hold. For example, if you bought 2 ETH at $1,800 each, enter 1800 as the buy price and 2 as the quantity.

Step 3:

Click the “Check Profit/Loss” button. You’ll see a green progress bar appear — it will fill up over 15 seconds, symbolizing the calculation process.

Step 4:

Once complete, your results will appear instantly. The calculator will display your total investment, current market value, and profit/loss in both USD and percentage.

Step 5:

If you want to share your results, simply use the WhatsApp, Facebook, X, or Telegram buttons below the result. The tool automatically generates a neat message with your data, ready to share with your community.

This simple 5-step process turns complex financial math into a fun, interactive experience.

6. Example Calculations

Let’s understand the calculator better through some real-world examples. These examples will show you exactly how it determines your crypto profit or loss.

Example 1: Bitcoin (BTCUSDT) Profit Case

Imagine you bought 1 Bitcoin at $30,000, and today the live market price fetched by the calculator is $35,000.

Your total investment = 1 × 30,000 = $30,000

Current value = 1 × 35,000 = $35,000

Profit = 35,000 − 30,000 = $5,000

Profit percentage = (5,000 ÷ 30,000) × 100 = 16.67%

So, your calculator result will show:

✅ Profit: $5,000 (16.67%) — highlighted in green.

Example 2: Ethereum (ETHUSDT) Loss Case

You purchased 2 ETH at $1,900 each, and the live market price is $1,700.

Total investment = 2 × 1,900 = $3,800

Current value = 2 × 1,700 = $3,400

Loss = 3,400 − 3,800 = −$400

Loss percentage = (−400 ÷ 3,800) × 100 = −10.52%

Your calculator result will show:

❌ Loss: $400 (10.52%) — highlighted in red.

Example 3: Dogecoin (DOGEUSDT) Small Price Movement

Suppose you hold 5,000 DOGE bought at $0.08, and now the price is $0.082.

Investment = 5,000 × 0.08 = $400

Current value = 5,000 × 0.082 = $410

Profit = 410 − 400 = $10

Profit percentage = (10 ÷ 400) × 100 = 2.5%

Even a small movement gives a clear picture of your returns.

This is the beauty of a live calculator — it tells you exactly where you stand in seconds.

7. Benefits of Using a Crypto Profit & Loss Calculator

A live crypto P&L calculator like this one offers multiple benefits to traders, investors, and crypto learners alike.

1. Real-Time Accuracy:

Prices in crypto markets change every second. Manual calculations can quickly become outdated. With this calculator, you get the latest values pulled directly from Binance’s live API, ensuring that your profit/loss is always precise.

2. Time-Saving:

Instead of juggling between exchange apps, spreadsheets, and calculators, you get everything in one place. In less than 15 seconds, you know whether you’re gaining or losing.

3. Ideal for Quick Decision-Making:

If you’re day trading or scalping, every second matters. Knowing your live profit percentage helps you decide whether to book profit or hold longer.

4. Visual and User-Friendly:

The color-coded profit/loss results (green for profit, red for loss) give you a clear, visual understanding of your performance.

5. No Login or Fees:

Unlike many paid portfolio trackers, this tool is completely free and requires no sign-up or API keys.

6. Safe and Private:

All computations happen inside your browser — no data is sent to any server, ensuring full privacy and security.

7. Educational for Beginners:

If you’re new to crypto, this calculator helps you understand how profits and losses are calculated and how price changes impact your holdings.

8. Perfect for Sharing Insights:

You can share your results directly to WhatsApp, Facebook, or X to discuss with your friends, trading groups, or crypto communities.

Overall, this tool empowers you to make smarter, faster, and more confident trading decisions — all with one simple click.

8. How Live Market Data Works (Simplified)

Ever wondered how this calculator fetches live prices from the internet? Let’s break it down simply.

The tool uses a concept called an API (Application Programming Interface). Think of an API as a digital messenger that allows two programs to talk to each other. In this case, your calculator sends a request to Binance’s public API and asks, “What’s the latest price of BTCUSDT?” Binance then replies instantly with a live value like “35000.55”.

This data is fetched in real-time using JavaScript and displayed on your screen without reloading the page.

For example, the API might return data like this:

The calculator then takes this live price, applies it to your buy price and quantity, and instantly calculates your total profit or loss.

This method ensures that you’re always working with current market rates — no more guessing, no more delays.

And the best part? Since the Binance API is public, you don’t need any registration or keys to access the data. Everything runs instantly and securely from your browser.

9. Importance of Real-Time Data for Crypto Traders

In the world of crypto, markets never sleep. Unlike traditional stock exchanges that close overnight, the crypto market runs 24/7. Prices can move dramatically at any hour — even while you’re asleep.

That’s why real-time data is absolutely critical for traders. Here’s why it matters:

Instant Reaction to Price Movements:

Live updates help you act fast when a coin’s price spikes or drops suddenly.

Avoid False Calculations:

If you use outdated prices, your profit/loss numbers will be wrong, leading to poor decisions.

Monitor Volatility:

Cryptocurrencies like BTC, ETH, or SHIB can move 5–10% within minutes.

Confidence in Trading Decisions:

Knowing your exact position builds confidence and reduces emotional decision-making.

The live calculator connects you directly to market reality. Whether you’re a long-term HODLer or a short-term trader, real-time data ensures that your calculations always reflect the truth of the market at that exact moment.

10. Manual vs Automated Crypto Calculations

Let’s compare how you would calculate profit and loss manually versus automatically using this tool.

Manual Method:

To find profit or loss manually, you’d use the formula:

Then calculate:

While it’s simple on paper, it gets tiring when you track multiple coins or frequently changing prices. You’d need to update prices constantly and risk miscalculations.

Automated Method (Using Calculator):

The calculator automatically does all of the above in seconds:

Fetches live price from Binance.

Performs all math instantly.

Displays color-coded, formatted results.

✅ No formulas, no errors, no manual updates — just quick, reliable results.

This automation makes trading less stressful and far more efficient, especially in fast-moving crypto markets.

11. Who Can Benefit from This Calculator

This live crypto calculator isn’t just for expert traders — it’s built for everyone involved in cryptocurrency in any capacity. Let’s see who can benefit the most:

1. Crypto Traders

Active traders — whether day traders, swing traders, or scalpers — can quickly calculate their current profit or loss in seconds. Instead of switching between Binance charts and spreadsheets, they get an instant overview of how their open positions are performing. This helps them decide when to book profits or cut losses.

2. Long-Term Investors (HODLers)

If you hold crypto assets for months or years, you can use this calculator to check your portfolio’s performance over time. Simply enter your buy price and quantity, and it’ll show how much your investment has grown (or dropped). This helps with long-term portfolio tracking without complicated tools.

3. Beginners Learning Crypto Basics

New to crypto? This calculator is a great learning tool. It shows you how small changes in price can affect your total returns. It’s a visual, interactive way to understand crypto price dynamics and market volatility.

4. Financial Bloggers & YouTubers

If you create crypto-related content, you can use this calculator to make your content more interactive. For example, you can show live examples of Bitcoin profits or Ethereum losses directly on your page.

5. Educators & Crypto Coaches

Trainers and mentors can use this calculator as a live teaching tool in webinars or workshops. It simplifies the math behind trading and helps beginners understand profit/loss fundamentals instantly.

6. Investors Managing Multiple Coins

The calculator supports 500+ live coins, meaning you can calculate results for different cryptocurrencies without using multiple apps.

So, whether you’re holding BTC, ETH, SOL, DOGE, or SHIB, this calculator gives you clear, fast, and accurate profit/loss data for every coin you trade or invest in.

12. Understanding the Result Breakdown

When you use the calculator, you get a detailed, easy-to-read breakdown of your investment summary. Let’s decode what each result means:

💰 Total Investment

This shows how much money you’ve spent to buy your crypto holdings.

Formula:

Example:

If you bought 2 ETH at $2,000 each, your investment = $4,000.

📊 Current Value

This represents the current worth of your holdings based on the latest market price fetched from the live Binance data.

Formula:

If ETH is now $2,200, your current value = $4,400.

💹 Profit / Loss

The difference between your current value and your total investment.

Formula:

If the result is positive → Profit (green)

If negative → Loss (red)

In our ETH example:

Profit = $4,400 − $4,000 = $400 Profit

📈 Profit / Loss Percentage

This is the percentage change from your initial investment.

Formula:

So, ($400 ÷ $4,000) × 100 = 10% Profit.

The calculator displays all these figures instantly, color-coded for clarity:

🟢 Green for profits

🔴 Red for losses

It even mentions the live coin price and data source, so you can trust that the information is current and reliable.

13. Social Sharing Made Easy

One of the coolest features of this tool is the built-in social sharing buttons.

After you calculate your profit or loss, you can share your result directly on:

WhatsApp 📱

Facebook 🌐

X (Twitter) 🕊️

Telegram 💬

This feature is perfect if you want to:

Show your trading results to your crypto friends or groups.

Discuss profit strategies with your trading community.

Share educational examples or insights on social media.

The calculator automatically generates a shareable message like this:

💹 My BTCUSDT Profit/Loss:

Buy: $30,000 | Live: $35,000

Profit: $5,000 (16.67%)

Try this calculator 👉 [Your Page Link]

Each button opens the respective app or social platform instantly — no sign-up, no login, no privacy risk.

It’s an effortless way to keep your trading circle updated and engaged.

14. Common Issues and Fixes

Although the calculator works smoothly most of the time, here are a few common issues you might encounter — and how to fix them easily.

1. “Failed to Load Coins” Message

If the calculator shows “Failed to load” under the coin dropdown:

Check your internet connection.

Ensure your browser allows JavaScript.

Sometimes, the Binance API temporarily limits requests — try refreshing after 1–2 minutes.

2. Live Price Not Updating

If the live price doesn’t appear:

Refresh the page.

Make sure you’ve selected a coin and entered both buy price and quantity.

If it persists, it could be a temporary issue with the Binance API.

3. Progress Bar Not Moving

This happens if your browser blocks setInterval() scripts.

Just reload the page or try another browser like Chrome or Edge.

4. Social Share Buttons Not Working

Ensure your device has the apps installed (WhatsApp, Telegram, etc.).

Some browsers restrict pop-ups — allow pop-ups temporarily for social links to open.

5. API Blocked by Browser Extensions

Ad-blockers or VPNs can sometimes block the API calls. Try disabling them temporarily when using the calculator.

These small tweaks can help you get the calculator running perfectly — every time.

15. Conclusion

The Crypto Profit & Loss Calculator is a complete, smart, and user-friendly solution for any crypto enthusiast. Whether you’re a beginner learning how profits work or a seasoned trader tracking multiple coins, this calculator gives you real-time clarity.

In just 15 seconds, you can:

Select your crypto coin,

Enter buy price and quantity,

View live profit or loss data fetched directly from Binance,

And share your results instantly.

No logins. No hidden charges. No complicated spreadsheets.

Just a smooth, modern, and accurate crypto calculation experience.

In the ever-changing crypto world, tools like this aren’t just helpful — they’re essential.

Use it daily to make smarter, data-backed trading decisions.

16. FAQs

1. How accurate is this calculator?

The calculator fetches real-time prices directly from Binance’s public API, ensuring highly accurate results at the time of calculation.

2. Which coins are supported?

It supports 500+ crypto coins available on Binance — including BTC, ETH, XRP, ADA, SOL, DOGE, and more.

3. Is it free to use?

Yes, it’s completely free and doesn’t require any registration or payment.

4. Can I use this calculator on mobile?

Absolutely! The calculator is 100% responsive and works seamlessly on both desktop and mobile browsers.

5. Does it include trading fees?

No, it calculates pure market profit or loss without considering exchange fees.

6. Can I compare multiple coins?

Currently, it supports one coin per calculation. You can refresh and check another coin instantly.

7. How often are prices updated?

The price is fetched live at the moment of calculation, ensuring real-time accuracy.

8. What if the API fails?

If the API fails temporarily, the calculator shows an error message. Simply refresh after a few seconds to retry.

9. Does it support non-USDT pairs?

Yes, any coin listed with a Binance price pair can be fetched and calculated, including BTCUSDT, ETHUSDT, etc.

10. Is my data safe?

Yes! All calculations happen inside your browser. No personal data is collected, stored, or shared.

Error-prone

Error-prone 100% precise

100% precise 5–10 mins

5–10 mins Instant

Instant Limited

Limited Full (Liquidation + P/L%)

Full (Liquidation + P/L%) No

No Yes

Yes Complex

Complex Simple

Simple

Live Price Integration (using API)

Live Price Integration (using API) Social Media Sharing (4 Platforms)

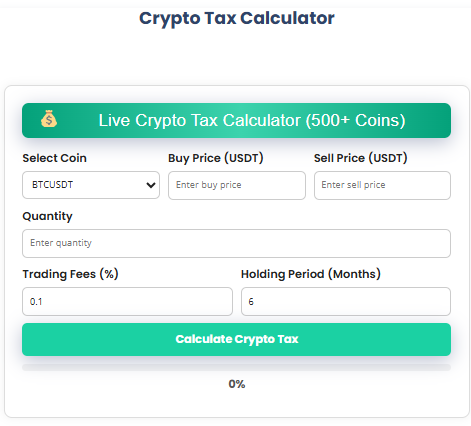

Social Media Sharing (4 Platforms) Shows Taxable Income, Tax Type, and Final Tax

Shows Taxable Income, Tax Type, and Final Tax Based on 2025 Indian Crypto Tax Rules

Based on 2025 Indian Crypto Tax Rules Works Without Login or API Key

Works Without Login or API Key